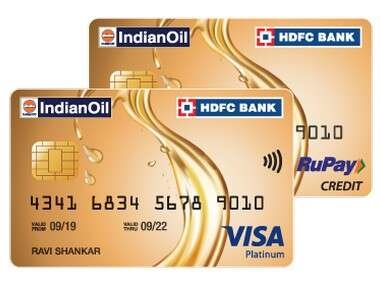

HDFC Bank in partnership with Indian Oil launched a co-branded fuel card for users from non-metro cities and towns, which will be available on both RuPay and Visa platforms.

The card was launched at an event here by IOCL's Executive Director (Retail Sales) Vigyan Kumar and HDFC Bank's Country Head, Payments Business and Marketing, Parag Rao.

The card offers customers highest rewards and benefits on fuel consumption and will be available on both RuPay and Visa platforms, it was informed on the occasion by the bank and IOC officials.

Speaking on the occasion, Vigyan Kumar said that Indian Oil has been a pioneer in promoting digital cashless and digital transactions with more than 98 per cent of the company's network of 27,000 plus retail outlets capable of accepting credit/debit card payments.

"In fact, more than 27% of all transactions at our petrol stations are through various digital modes. We are confident that this collaboration with HDFC Bank today shall give a boost to digital payments and cashless transactions in the country, in line with the Digital India vision of the prime minister," he said. Rao said it is their endeavour to take digital forms of payments to the smaller towns and cities.

He said fuel consumption in India is rising and smaller cities and towns are major drivers of this growth. "With more than 75% of our total branch network in such non-metro cities, we want to empower our customers in these locations by providing a product that is specifically designed for their changing needs and aspirations," he said.

Rao, who is the brain behind this card, said, "Our philosophy in terms of offering products across HDFC Bank is very simple. We try to see the primary top two needs of an individual and try to design a product which is focused on these needs of the customer." "Also, one of our and IOC's objectives in launching this card is to assist in this whole digital mission of saying how do you reduce cash. We have lot of other initiatives with IOC in terms of digitization.

"Simultaneously, as a bank, we are also expanding our merchant network everywhere so that a merchant in the rural area, either through a POS (a point of sale machine, which is an electronic device used to process card payments) machine or an app, we have a merchant app, could start accepting digital payments, which could be a card, other wallets etc".

"In India, the penetration of electronic spends at customer level, I am not talking of institutions and businesses, is only about 10-12%, rest is still cash and cheque, so we have got a lot of space to grow...," Rao said.